CoStar Insight | Three Key Office Trends of 2023

CoStar Insight | Three Key Office Trends of 2023

By Phil Mobley

CoStar Analytics

October 27, 2023 | 1:45 P.M.

In a few years, people could look back at 2023 as the first year of the true, new normal for the commercial office market.

With most vestiges of the pandemic in the rear-view mirror, a normalization of the labor market and consistent leasing behavior signify what could be in store for the property type in the next few years. Among these signals are three trends that look likely to persist into 2024 — and perhaps beyond.

Trend 1: Office Attendance Stabilizes

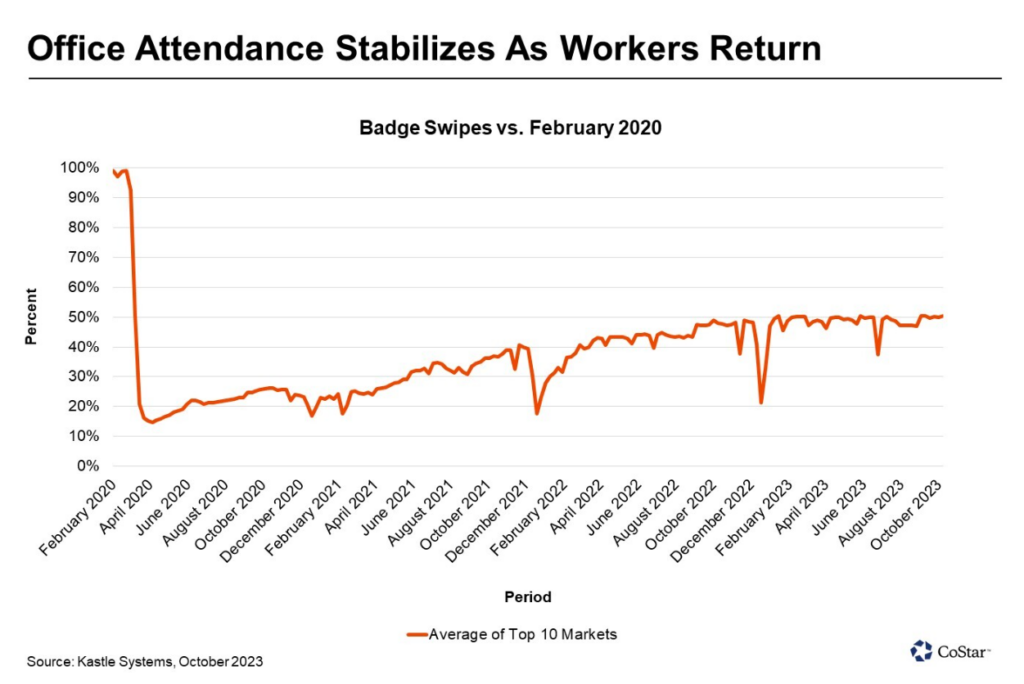

The Kastle Systems Back to Work Barometer is not perfectly representative of all office buildings in the United States, but its trend is insightful. Excluding the holiday weeks of Jan. 1 and July 4, its weekly measure of office attendance as a percentage of February 2020 levels has kept within the narrow range of 46.4% to 50.4%.

In addition to the overall trend, Kastle’s data also clearly shows higher attendance in the middle of the week. For example, while overall attendance in September of 2023 was only marginally above that of the same month last year, it was notably higher on Tuesdays, Wednesdays, and Thursdays. On Mondays, it was virtually unchanged; on Fridays, it was slightly lower.

On these midweek “peak” days, according to Kastle, the return to office is approximately 10 percentage points higher than the index’s average value. It is likely somewhat higher still at offices that remain formally occupied. Adjusting for increased vacancy since 2019 implies that attendance at occupied offices is perhaps an additional 5 percentage points higher than the index average.

Thus, the floor for office utilization has been raised in 2023, and it will likely move somewhat higher. There continue to be regular announcements by major employers seeking more frequent attendance, such as Nike’s requirement of four in-office days starting in January. On the other hand, the slow upward movement of the Kastle index so far suggests that a large increase is likely to take some time.

Trend 2: Employment Growth Slows

The recovery and subsequent growth of office-using employment after the large layoffs in the spring of 2020 was nothing short of staggering. From May to December of 2020, private sector office-using employers hired 1.7 million workers. They then hired another 1.8 million in 2021 and 1.1 million in 2022. By early 2023, things had slowed down. There were 208,000 office-using jobs added from January to May, a hiring pace comparable to that of 2019.

Since then, however, job growth has been flat to negative, with office-using employers trimming payrolls by 31,000 from June through September. The tech-heavy information sector has led the pullback, reducing employment by 93,000 since November of 2022.

The proximate cause of the slowdown in hiring is near-term economic uncertainty. A rapid increase in interest rates has slowed down several sectors of the economy, and employers are still bracing for the possibility of a recession in the next few months.

There are also longer-term headwinds. So far in the new millennium, office-using employment has grown by 1% per year. But structural demographic and immigration factors are likely to slow this down in the years ahead, even absent a recession. Oxford Economics forecasts that annual growth will average only 0.4% over the next eight years, less than half the historical average. Such a scarcity of future office-using workers would further complicate the sector’s recovery.

Trend 3: Leases Get Smaller

The implications of the first two trends on tenants in the leasing market are complex. A renewed commitment to the importance of in-person work is combining with lower average attendance and slower growth prospects to generate heightened scrutiny on space utilization and, therefore, on footprint requirements. One result is smaller leases.

Through the first three quarters of 2023, the total volume of new office leases is 17% below what it was during the identical period in 2019. At the same time, a 7% increase in the number of transactions shows that more tenants have been active in the market than there were then. The decline in volume, then, is driven by the average deal size, which is down 22%.

The willingness of tenants to commit to new space — but less of it — is illuminating. In a break from their behavior in 2020 and 2021, fewer tenants have been executing short-term extensions when their leases approach expiration. Now, more of them are choosing not to renew, looking instead to relocate to better, smaller offices.

It appears as well that a sharp focus on space utilization is a factor in these leasing decisions. Having paid rent throughout the pandemic era, even when most of their workers were absent, many occupiers are eager to realize the cost savings that come with less space.

One way in which tenants may be accomplishing this is by tailoring their workplaces to their existing workforces rather than planning for future growth. In today’s favorable market, they have little incentive to lease beyond the needs of their current headcount, especially if they expect to do less hiring. With a turbulent 2024 on the horizon, and more than half of pre-2020 leases still yet to face expiration, efficiency could be the enduring legacy of 2023’s office market.